Resources

Content Type:

Industry:

Topic:

Revamped Reporting: Kansas Businesses Shift from ‘Annual Reports’ to Biennial ‘Information Reports’ in 2024

In a move aimed at reducing administrative burden, Kansas Secretary of State Scott Schwab is ushering in a significant change for businesses across the state in 2024. Instead of the annual reporting requirement, businesses will now file 'Information Reports' every two years. This reform is expected to free up valuable time for Kansas business owners, enabling them to focus more on their core operations and less on bureaucratic paperwork.

The art of the practical: Adopting AI in a responsible way

Insights and best practices on how to navigate the intricate AI environment and drive enhanced growth and efficiency.

IRS announces 2024 standard mileage rates

The IRS has announced the 2024 Standard Mileage Rates. Understand how these rates will affect your deductions for business, medical, moving, or charitable driving expenses. Explore this article to stay informed and plan ahead for your 2024 tax returns.

Don’t miss the January 16th deadline for final 2023 quarterly estimated tax payments

Time is ticking towards the January 16th deadline for the final 2023 quarterly estimated tax payments. Don’t let this date slip by unnoticed!

IRS announces details for ERC Voluntary Disclosure program

IRS provides VD Program for employers to return ERC refunds and avoid penalties and interest. Employers must apply by March 22, 2024.

Year-end giving strategies for 2023

Make your year-end giving count! Discover the best strategies for 2023 to maximize your charitable contributions and tax savings in our latest article. Dive into the specifics of smart donating to ensure you're making the most of your generosity.

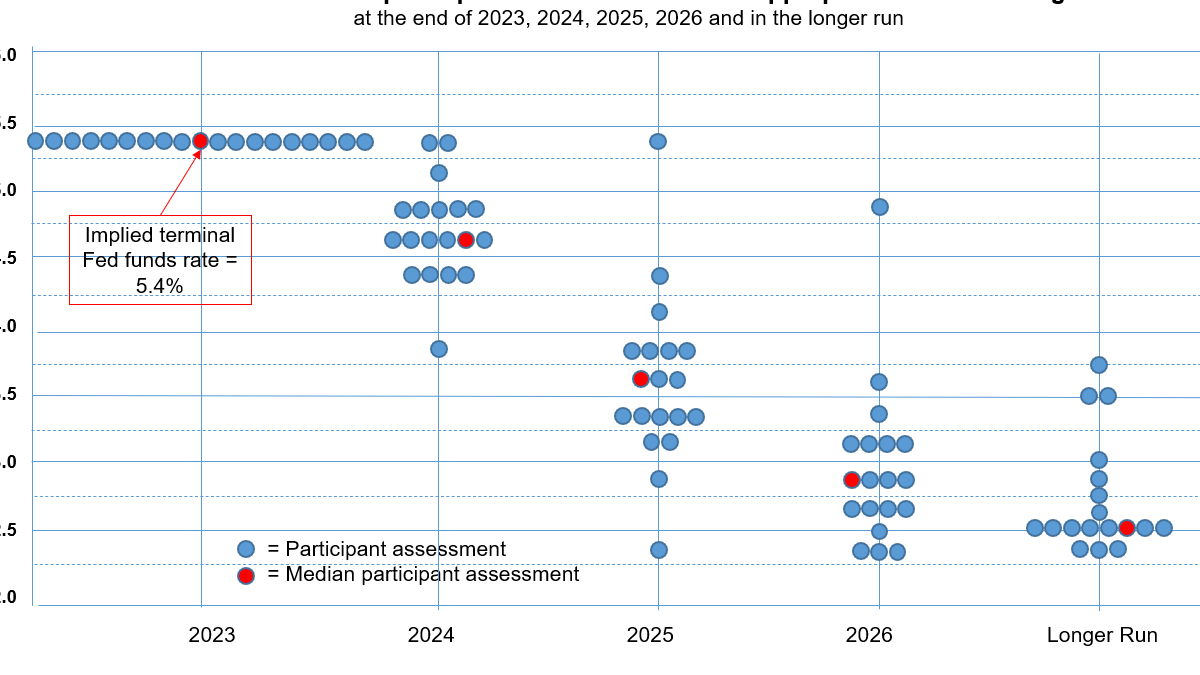

Fed signals end of rate hikes and projects cuts in 2024

The Federal Reserve signaled at its meeting on Wednesday that it is done raising its policy rate and is poised to reduce it by 75 basis points next year to support the expanding economy.

IRS delays implementation of lowered form 1099-K reporting threshold

The IRS has postponed the implementation of the new lowered reporting threshold for Form 1099-K. Learn more about this tax form and the impact of this delay on your financial planning.

What To Do With Old Retirement Accounts

You likely have at least one old retirement account if you've ever changed employers. These accounts stay exactly as you left them unless you take action. In this video, we'll provide options for what to do with those old accounts.

The 1031 Exchange Explained

In the world of real estate, the Section 1031 exchange has been a significant tool for investors who want to grow their real estate portfolio and wealth. In this video, we'll explain how a 1031 exchange works and important considerations when using one.

IRS delays implementation of lower $600 reporting threshold for 1099-K

New IRS notice 1099-K for small vendors will be subject to existing requirements for TY 2023, followed by a phased-in approach.

IRS Releases 2024 tax inflation adjustments

IRS releases inflation adjustments for 2024. Inflation adjustments impact individual tax brackets and other various provisions of the Code.

Two Estate Planning Strategies to Help Protect Wealth

A goal of estate planning is to maximize the wealth that is passed on to one's heirs. In this video, we'll discuss how a Spousal Lifetime Access Trust and an Irrevocable Life Insurance Trust may help you minimize estate taxes and protect wealth.

IRS releases 2024 retirement plan limitations

Cost-of-living adjustments to retirement plan limits for 2024 have been issued by the IRS in Notice 2023-75.

The Key Functions of Your Nonprofit Board

Nonprofit board service can be as exhausting as it is rewarding. Whether you are on a board yourself, thinking about joining a board, or seeking to improve the one you sit on, here are three things that high-functioning nonprofit boards get right.

No results found.